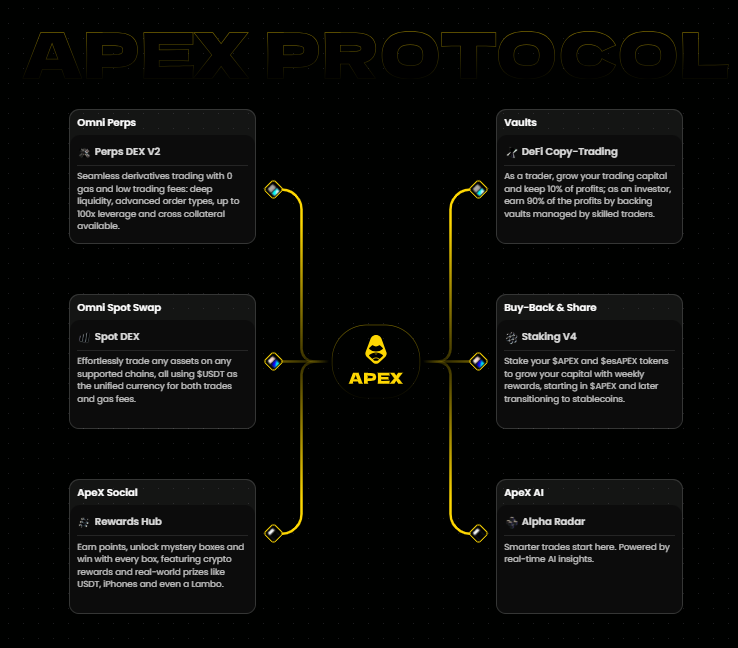

Decentralized exchanges have evolved rapidly. While early DEXs were simple token swaps, modern platforms now compete with centralized exchanges by offering features like derivatives, leverage, cross-chain swaps, and social trading. Apex Omni (sometimes called Omni ApeX) is one such protocol, positioning itself as a unified multichain DEX that brings together liquidity, speed, and usability under one roof.

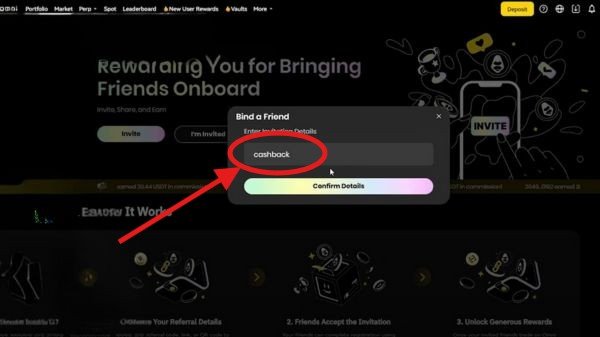

If you use the Apex Omni Invitation Code “cashback”, you become eligible for a $100 bonus and enjoy 10% off your trading fees when you sign up through the correct link. (The affiliate link is embedded in this article.)

Throughout this guide, we’ll walk you through the features, architecture (drawing on the Apex omni litepaper), and how to use that invitation code effectively — without overusing it.